- Delisting of already hated stock resulted in forced/indiscriminate selling

- Stock down over 44% in one day

- Balance sheet consists primarily of liquid assets

- Insiders own majority of shares

- Off the beaten path: Mkt cap = $11.6 million

- P/NCAV = 0.24

- P/TB = 0.17

- P/NNWC = 0.38

On Jan. 22, 2016 QCCO announced plans to delist its stock from the NASDAQ and only provide financial information to stockholders upon request. The following trading day the stock fell off a cliff. QCCO closed at $0.6676 (down 44.38%) while reaching a low of $0.54. I believe the slump is due to indiscriminate selling. While one can make the argument that the stock should trade at a lower valuation because of less liquidity and increased risk. The company will also save money due to lower administrative and legal expenses. At least the drop seems too severe.

“QC Holdings, Inc. Announces Voluntary NASDAQ Delisting and SEC Deregistration

OVERLAND PARK, Kan., Jan. 22, 2016 (GLOBE NEWSWIRE) — QC Holdings, Inc. (NASDAQ:QCCO) announced today that it has notified the NASDAQ Stock Market (“NASDAQ”) of its intention to voluntarily delist its common stock from the NASDAQ Capital Market. The Company intends to cease trading on NASDAQ at the close of business on February 11, 2016. The Company’s obligation to file current and periodic reports with the Securities and Exchange Commission (“SEC”) will be terminated the same day upon the filing of the requisite notification with the SEC. The Company is eligible to deregister its common stock because it has fewer than 300 stockholders of record.

Following delisting and deregistering, the Company presently intends to provide annual information regarding its performance upon stockholder request. The Company’s shares may be quoted in the “Pink Sheets” (www.pinksheets.com), an electronic quotation service for over-the-counter securities. However, there can be no assurance that any market maker or broker will continue to make a market in the Company’s shares.

The Company’s board of directors determined, after careful consideration, that voluntarily delisting and deregistering is in the overall best interests of the Company and its stockholders. Factors that the board of directors considered include the cost savings that will occur as a result of the elimination of the Company’s obligation to file reports with the SEC, the avoidance of additional accounting, audit, legal and other costs and management’s attention devoted to compliance with the requirements of the Sarbanes-Oxley Act of 2002, the historically low daily trading volume in the Company’s shares, and the benefit of allowing management to focus on the long-term development of our core business.”[1]

QC Holdings provides financial services for underbanked customers in 22 States within the USA and in Canada. QCCO advances primarily single-pay loans (payday loans) (~2/3 of revenue) and installment loans through retail branches and their internet lending operations. Payday loans are small short-term loans. The average term of a payday loan is 18 days.[2] The average amount (principal +fee) is $383. Fees represent $59 of that amount so the average fee per $100 advanced is $18 for 18 days![3] This equates to an extremely high annualized interest rate. Many states effectively have banned or have tried to ban payday loans by imposing limits on the annual percentage rate (APR) that can be charged. There were, for example, efforts in Missouri, which accounts for 32% of the gross profit, to place a voter initiative on the statewide ballot for each of the November 2012 and 2014 elections. The voter initiative was intended to place a limit APR of 36% on any lending in the state. There weren’t enough valid signatures, however, to place the initiative on the ballot of either of the elections. Such a limit would render the provision of payday loans unprofitable.

The amount advanced under installment loans ranges from $400 to $3000.

QCCO offers branch-based installment loans to customers in eight states. Branch-based installment loans are very similar to payday loans in principal amount, fees and interest, but allow the customer to repay the loan in bi-weekly installments. In 2014, branch-based installment loans were offered in 194 locations and accounted for 13.7% of total revenues.

During 2014, the average principal amount of a signature loan was $1,845 and the average term was 20 months. In 2014, signature loans accounted for 10.6% of revenue and were offered in over 200 locations in Arizona, California, Idaho, Missouri, New Mexico and Utah.

Auto equity loans are higher-dollar installment loans secured by the borrower’s auto title with a typical term of 12 to 48 months and a principal balance of up to $15,000. Fees and interest vary based on the size and term of the loan. During 2014, the average principal amount of an auto equity loan was $3,421 and the average term was 32 months. As of December 31, 2014, QCCO offered auto equity loans to customers at 134 branches in Arizona, California, Idaho, New Mexico and Utah.[4] In February 2015, the Company completed the sale of its auto facility for approximately $1.2 million, net of fees to an unrelated third party. The net book value of the property sold was approximately $1.2 million.[5]

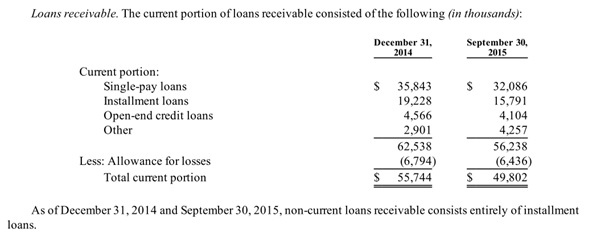

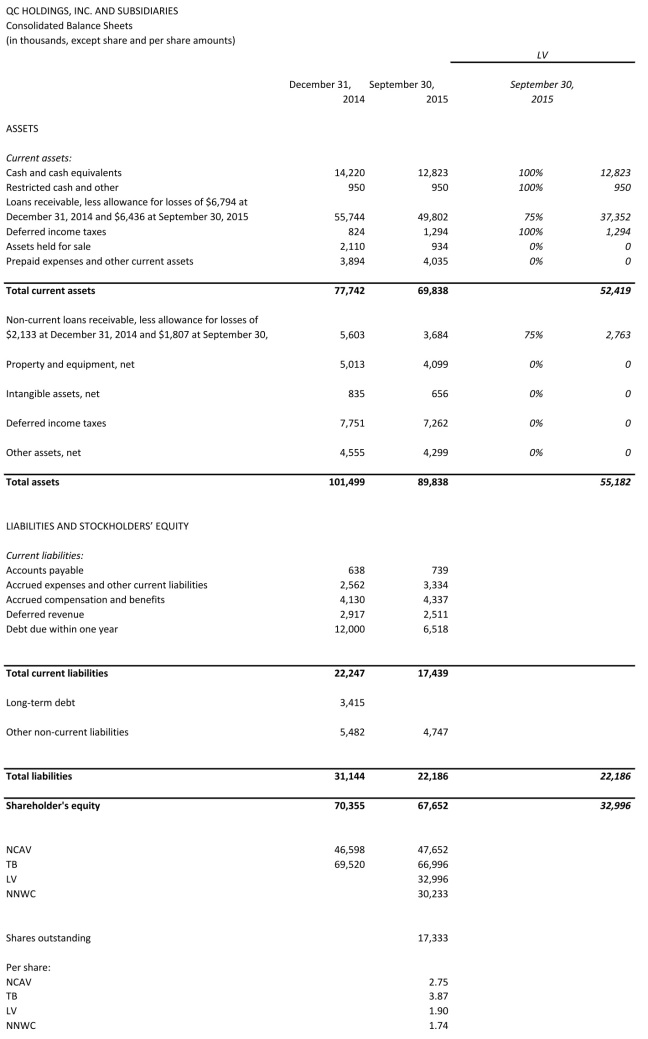

The balance sheet consists primarily of cash and short-term loans receivable. How much are the loans receivable worth? I think close to book value. To be conservative, however, I cut off 25% for my liquidating value.

“The overall provision for payday loan losses during 2014 was approximately 2.8% of total payday loan volume (including Internet lending). On average, the overall provision for payday loan losses has historically ranged from 2% to 5% of total payday loan volume.”[6]

Below are the calculations of net current asset value (NCAV), tangible book value (TB), liquidating value (LV) and net-net working capital (NNWC).

Source: 10-Q 09/2015

There are some things I really don’t like about this company. First, I am very skeptical about the viability of the business. Customers explore alternatives and many states want to effectively ban the services QCCO provides. Yet, management stated their intention to expand the business. Second, the compensation of management is high. There is also a loan from the chairman to the company at a 16% interest rate.

On the other hand, management owns the majority of the stock outstanding. Owning over 8 million shares the chairman should be incentivized to act in the shareholder’s best interest — even after considering the high compensation.

I have no opinion where the stock will trade in the short-term. It can certainly become much cheaper. Dark companies can trade at extreme discounts. I think, however, the stock is a good statistical bet at this price. I like the high liquidity of QCCO’s assets and the alignment of the shareholder’s and chairman’s interest due to his substantial stock holding.

Disclosure: I currently have no position in QCCO but intent to initiate a long position in the next days.

[1] 8-K 01/22/2016 Exhibit No. 99.1

[2] 10-K 2014, p. 7.

[3] 10-Q 09/2015, p. 25.

[4] 10-K 2014, p. 8.

[5] 10-Q 09/2015, p. 8.

[6] 10-K 2014, p. 7.

A very real risk is that the company may go dark and not post their financial statements on otcmarkets.com or on their site.

LikeLike

This is what I expect. I’m pretty sure this is what they mean by: “Following delisting and deregistering, the Company presently intends to provide annual information regarding its performance upon stockholder request.” I’m okay with that at a low enough price.

LikeLike

Thanks for your post. I think they will send annual reports by email. But you have to send them an email telling them that you are a shareholder and that you would like to get these reports. I even think it is their legal obligation to do this.

LikeLike

Hi Ruerd! This is what I think, as well. If they don’t respond to email you may have to call the CFO.

LikeLike

Thanks for a good analysis! QCCO does look really attractive looking at the numbers, I thought so even before the price plummeted after announcing the delisting.

What worries me most is the delisting, I have no prior experience with that. For instance, do you think there’s a problem if you buy a lot of stock now and then intends to sell them in the future at (what I guess) is a much more limited market?

The announcement also included:

”Co intends for its shares to trade on pink sheets, but there can be no assurance that any market maker or broker will continue to make a market in co shares.”

That sounds a bit frightening, or maybe that’s just a standard precaution that doesn’t translate to a problem in practice?

Regulations on these type of businesses seem also quite imminent, I have heard February mentioned as a goal for that. Here’s an article that summarizes the intended changes quite well:

https://morningconsult.com/2015/12/sweeping-rules-for-payday-lenders-expected-soon/

QCCO also have large post of leasing, about $60M is mentioned in the latest 10-K. But most of that is “reasonably assured renewals” which I translate into “they intend to renew those leases but don’t have to”. What remains is about $20M of leasing, but it seems they expire within a couple of years so it shouldn’t have to be much of a burden if they have to downsize due to new regulations.

Though, overall, it looks to me like a rare opportunity. Historic cash flow and earnings are great compared to the current market value and the balance sheet is just as great. If they can continue business almost as usual it is fantastic buy, if they can’t then the balance sheet gives a lot of protection during the downsizing.

What worries me most is the actual delisting, so if you can share your views on that, it would be very appreciated 🙂

LikeLike

Thanks for your comment and the additional insights. The point about operating leases is a good one. I agree that they aren’t too much of a burden, though. In addition to the short remaining life, one thing to remember is that they aren’t only an off-balance sheet liability, they are also an off-balance sheet asset.

”Co intends for its shares to trade on pink sheets, but there can be no assurance that any market maker or broker will continue to make a market in co shares.” That’s just boilerplate.

The liquidity of the stock will probably be lower. However, you should be able to trade the stock. Just put in a limit order and wait. If you are patient, you can trade almost any stock. It is amazing what small stocks you can trade. I recently got some shares, though not as much as I wanted, of a company that trades OTC and is going to go dark. It has a free float below $200K and trades at P/NCAV of about 0.1! I put in a limit order, waited a few weeks and got filled.

Andrew Walker and Nate Tobik talked about trading very small/dark companies here: http://www.thebulldoginvestor.com/2015/12/24/mi-29-interview-with-andrew-walker-portfolio-manager-at-rangeley-capital-and-special-situations-enthusiast/

QCCO has some resemblance with the kind of situations they talked about.

LikeLiked by 1 person

It depends also on your broker. For me it is quite expensive to trade OTC stocks. The broker charges a daily minimum fix fee. So if I buy (or sell) OTC stocks over several days, because of the low liquidity, I pay this fee every day even if a very low amount of stocks is acquired.

LikeLike

I hear something like this quite often. You may want to switch your broker then — or just open a new account for OTC ideas. I always recommend Interactive Brokers. It’s really the best broker I’ve ever had in terms of commission and execution. There may be valid reasons why one has to stick to an inferior broker, but, for an enterprising investor, the hassle to open a new account isn’t one of them. On several occasions I opened a new account just for a single idea.

LikeLike

Just a quick update on the disclosure: I’m now long QCCO.

LikeLike

Great write-up, thank you! 🙂

LikeLike

Thanks, Jonas!

LikeLike

Hi again. QCCO just recently changed their “tier” to “limited”. This is my first Pink Sheets stock, so I’m not fully aware of the cause and consequence. Too bad anyhow, since I was hoping for a quite good Q2.

LikeLike

Hi, Claes!

I corresponded with Doug Nickerson, the CFO, today. (He is very responsive, by the way.)

He told me that they still intend to provide quarterly financial information. They expect to provide the second quarter info in the next couple of weeks.

LikeLike

It sounds promising with a responsive CFO. Looking forward to the Q2 then. CFPB has a new deadline before the end of the year, so it’ll be interesting to see where it all ends up.

You are very helpful. Feel free to contact me if you have any IT-related questions in investing (Quantopian, screener.co etc) and I would be happy to try to return the favor.

LikeLiked by 1 person

Glad to hear.

Will do when something arises. Thank you, Claes!

LikeLike