- Profitable Japanese net-net

- 51% discount to NCAV

- 62 % discount to NCAV + net long-term investment securities and deposits

- 69% discount to tangible book value

- Negative enterprise value

- Management guides to a profitable FY

- US$12.7 million market cap

- Reporting in Japanese, only

- Holding ~15% of own shares in treasury

Solekia Ltd. engages in the IT-related business. It operates through the following segments: Tokyo Metropolitan Area, Eastern Japan, Western Japan, and Others. Solekia sells electronic devices, electronic wires and cables, wire related products, data processing system and software, and telecommunication equipment. The Company also designs, develops, and provides consultation for semiconductors, information and communication systems, and multimedia systems. The company was founded in 1958 and is headquartered in Tokyo, Japan.

The company is currently profitable and management expects the second half and the full FY ending March 31, 2016 to be profitable, as well:

Guidance for fiscal year ending March 31, 2016:

Sales: ¥21.300 million

Operating income: ¥170 million

Ordinary income: ¥195 million

Net income: ¥70 million

Net income per share: ¥80.58

Solekia is tiny. Its market cap is ¥1,526 million (= $12.691 million). Only reporting in Japanese, the stock is under the radar for a substantial part of the investing community. The company owns roughly 15% of its issued shares. Many databases provide inaccurate information for Solekia. Together this makes the stock truly off-the-beaten-track.

Solekia trades at a 51% discount to NCAV. If one includes net long-term investment securities and deposits, the discount increases to 62%. I found nothing that would qualify as a hard catalyst. I also couldn’t find signs of off-balance-sheet liabilities, contingent liabilities or significant litigation. The thesis is plain mean reversion.

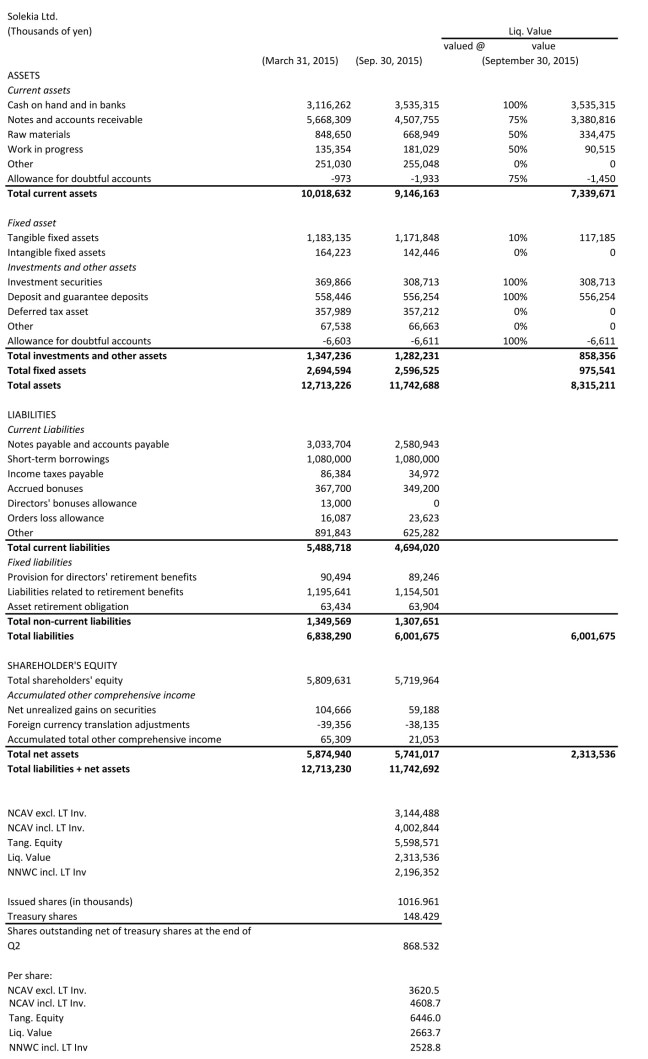

Below is the translated balance sheet using Google Translate, the approximation of liquidation value and the calculations of net current asset value, net-net working capital and tangible book value.

(Source: Quarterly Report for the Second Quarter Ending September 30, 2015 Translated via Google Translate)

(Source: Quarterly Report for the Second Quarter Ending September 30, 2015 Translated via Google Translate)

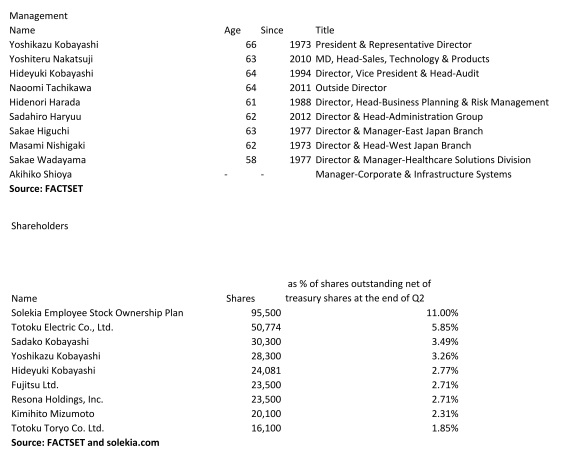

The President owns a small amount of shares.

Disclosure: I currently have no position in 9867:Tokyo.

I cannot read Japanese and rely on Google Translate to read the documents. I might miss something important.