On Friday 10/23/2015 Art Vivant announced a favorable outcome of a legal dispute. In response, management raised the profit guidance and declared special dividends. I took advantage of the subsequent surge in the stock price and sold my position for a +56% gain in two months.

Art Vivant Co Ltd (7523:Tokyo)

Profitable net-net, inaccurate database numbers, small market cap

Art Vivant operates in art related businesses. The business model is however quite diffuse. According to the Japan Company Handbook, the company is a top ranked seller of modern lithography art and other artworks. The company targets customers in the range between 20 and 30 years old. The company is also engaged in the operation of fitness clubs, yoga studios, an app called “Wonder4World” and a hotel under the name “Tarasa Shima Hotel and Resort”. Art Vivant also provides financial services with artworks as collateral.

Management guides to a net profit of ¥510 million or ¥39 per share for FY 2016. Note that this information might be hard to find for foreign investors. This information, like the information regarding the shares outstanding, is on the first page of the quarterly report. For some reason, this page is formatted as a picture. Hence, an electronic translator like Google Translate will not translate this information. There is no way of knowing, by looking at the translated document, that this information is even there. The company reports in Japanese, only.

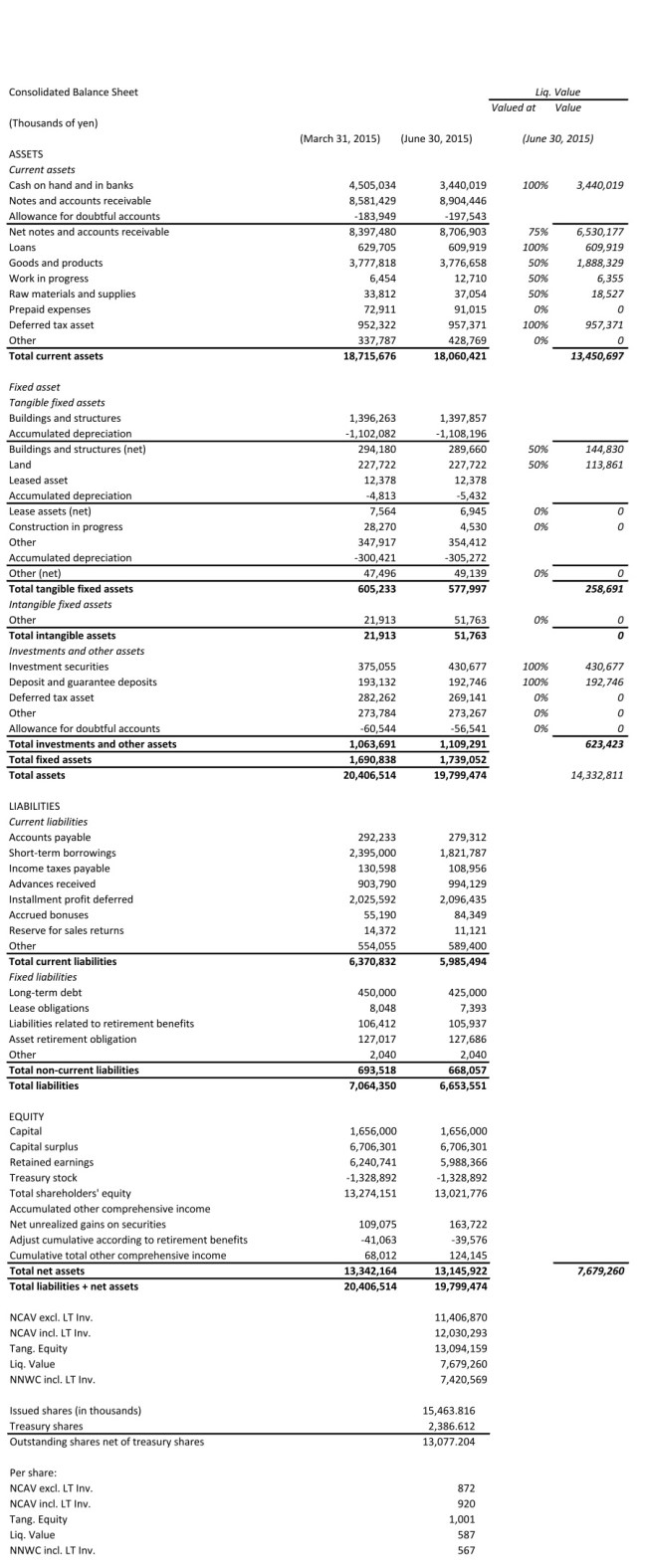

The company owns 2.387 Million treasury shares. This represents 15.44% of the 15.464 Million total issued shares. Thus, there are 13.077 million shares outstanding net of treasury shares. As I pointed out in the Uehara Sei Shoji Co write-up, many databases calculate an inaccurate market capitalization for Japanese companies as they don’t subtract treasury shares from issued shares. This is also the case for Art Vivant. Hence, superficial screens overestimate the market cap and, as a result, the valuation for Art Vivant. Based on the current market price of ¥344, the correct market cap is ¥4.499 billion (= $37.57 million). With such a small size, institutional investors are effectively excluded from investing in this company. The lack of institutional investors paired with inaccurate database numbers and hard to get financial information might result in the deep neglect of the stock.

Art Vivant trades at a 61% discount to its NCAV. If one includes investment securities and deposits in NCAV, the stock trades at a 63% discount. While the investment securities and deposits are technically non-current assets, it makes sense to include them in NCAV, I think, because of their liquidity.

Below is the translated balance sheet (using Google Translate), the calculations of NCAV and an approximate liquidation value:

(Source: Quarterly report for the first quarter of FY 2016)

Disclaimer: This stock represents only a small percentage of my net-net basket. Stocks in this basket are picked based on quantitative variables. Almost no qualitative analysis is performed for these statistical picks.

Disclosure: The author is long 7523:Tokyo.